Stocks Nearing Multiple Cycle Peak

Stocks Nearing Multiple Cycle Peak;

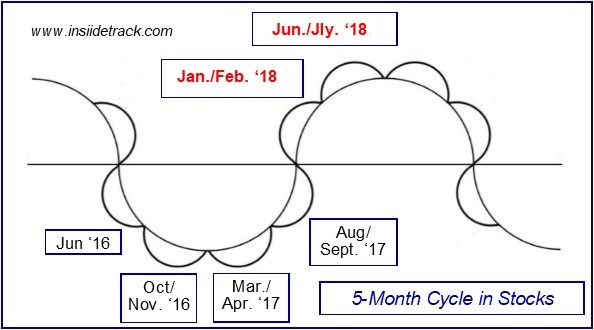

5- & 10-Month Cycles Converge

Mid-Jan. – Mid-Feb. 2018 = Likely High.

01/05/18 INSIIDE Track: As many Equity markets advanced throughout 2017, stretching multi-year cycles to their extremes. Since their Nov. ‘16 breakout higher, they have been tracing out a ‘5’ wave advance that entered an accelerated phase after a vulnerable period lapsed in Nov. ‘17. The next vulnerable period surrounds March 2018…

As the ‘Transition Year’ of 2017 fades into history, it is important to take stock (pun intended) of where equity markets stand… and what is expected in the coming months & years. 2017 was expected to be the culmination of diverse bullish cycles and to transition into a period (2018 – 2019… potentially stretching into 2022) when equity markets would encounter greater challenges.

From a very broad perspectives, the 40-Year Cycle was factored into this analysis. This has been one of the most consistent cycles throughout America’s history (though it also has a larger margin of error) – timing major Currency Wars and related economic stresses every 40 years.

40-Year Cycle

Due to its magnitude, the 40-Year Cycle is the hardest to pinpoint the timing of individual components since they alternate their sequence during each successive phase. In some phases, a gold & silver challenge occurred in the first half (the ‘3’ year into the ‘7’ year; e.g. 1853 – 1857) while in others it has been concentrated in the second half (the ‘7’ year into the ‘1’ year of the ensuing decade).

In some of the 40-Year Cycle phases, a large economic panic and/or stock market decline occurred in the first half (1893 & 1973) while during other phases that decline has been in the second half (1819 – 1821, 1857 – 1861)…

2017 – 2020/22 is expected to act similar (history rhymes but does not repeat) to those three previous phases of the 40-Year Cycle – experiencing at least one, and probably multiple, declines of 15 – 30% at some point in that cyclic downturn. In each case, this correction was not as severe as one that had immediately preceded it, which is why 2017 – 2022 is more likely to resemble 1977 – 1982…

7-Year Crash Cycles & Cycle Lows

One of the most significant contrasting cycles was/is the 7-Year Crash Cycle (and its 14-Year Crash Cycle multiple) – a recurring cycle that times equity declines of 30 – 50% & ensuing lows.

It was forecast to time a multi-year peak in late-2014 and an ensuing drop into 2016 (when a related 7-Year & 14-Year Cycle Low – linking decisive lows in 2009, 2002, 1988, 1974 & 1932 – was projected to time a multi-year low).

While this decline was not as pervasive as some, it triggered 30 – 50% (up to 70 – 80% in some cases) equity declines in many sectors – including oil & energy, metals & mining, agriculture, air & transportation, chemical, retail, shipping & even key tech stocks like HP, Seagate, Western Digital, Micron, Yahoo & Applied Materials.

It also timed crashing global equity markets, most notably that in China. The majority of those declines culminated in 1Q 2016 – exactly 7 years from the 1Q 2009 equity bottom.

That was/is one pair of multi-year cycles that turned positive in 2016 and do not anticipate a similar Crash Cycle until 2021 – 2023.

One impending aspect of this 7-Year Cycle is its midpoint – a 3.5-Year Cycle. ~3.5 years before the 3Q/4Q 2007 peak was an intervening high in 1Q 2004. ~3.5 years after the 3Q/4Q 2007 peak – and ~3.5 years before the late-2014 cycle high – was a secondary high in 2Q 2011. ~3.5 years after the 4Q 2014 cycle peak is 2Q 2018.

Monthly Cycles

As the markets entered 2017, two decisive monthly cycles were identified & cited – for April & Sept. 2017 – when the pivotal lows of 2017 were expected. Overlapping monthly cycles – in some Indexes – added a third important time for a pivotal low – in late-June 2017…

Looking ahead into 2018, an important low has been expected in March 2018, with another low likely in June 2018. However, the most significant bottom is likely to wait until late-year – expected in 4Q 2018.

That is the latest phase of a ~3.25 year (12 – 13 quarters) low-low cycle that has timed important lows in 3Q 2002, 4Q 2005, 1Q 2009, 2Q 2012 & 3Q 2015. The next phase comes into play in 4Q 2018…

From a wave perspective, most indexes continue to show an evolving – and accelerating – 5th of 5th of 5th wave advance. While that has not yet triggered any convincing signs of a larger-degree peak, it does provide some expectations for what should follow that ultimate top.

3 – 5 year equity traders & investors could use a weekly close below XX,XXX/DJIA to lighten up… Until that occurs, the trends remain very strong.”

Stock Indices remain positive, as they near the convergence of 5 & 10-Month Cycles that timed almost every critical low of the past three years. Both of those cycles are now expected to invert and time a multi-month peak between mid-Jan – mid-Feb. 2018. Price action will continue to govern, filter and/or hone these cycles and provide more specific expectations & strategies.

See Weekly Re-Lay & INSIIDE Track for additional details.