Stocks Signaling Peak III…

Stocks Signaling Peak III…

Completing Cycle Progressions;

Feb. ’18 Ushers in Reversal Period.

01/31/18 INSIIDE Track: Equity markets advanced throughout 2017, accelerating higher after mid-Nov. Since 2016, they have been tracing out a ‘5’ wave advance that could peak at this time (mid-Jan. – mid-Feb. ‘18) – the culmination of 5-month & 10-month Cycle Progressions. A vulnerable period surrounds March 2018…

As they trade through this period, stock indexes are expected to encounter greater challenges as the effects of those remaining bullish cycles wane. It is price action, however, that dictates what & when to expect corresponding moves.

Monthly Cycles

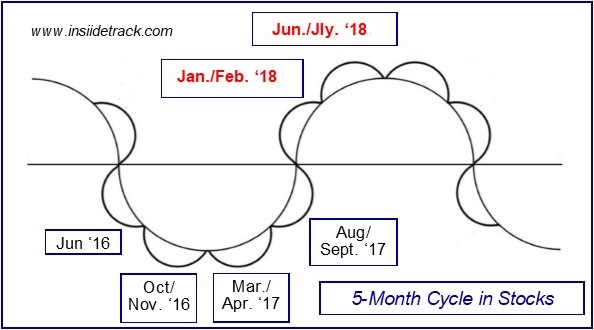

During this period – when long-term cycles alternate between synergy & separation – two decisive monthly cycles pinpointed almost every crucial low (and several highs) of the past 3+ years. Those were the 5-month & 10-month low-low cycles.

The accompanying diagrams illustrate the last several phases of both these monthly cycles. Those cycles have been a primary focus of these publications since 2015 and heavily influenced the intra-year outlook for 2017 – that called for two pivotal lows in April & Sept. 2017. With both of those cycles being fulfilled, it reinforces the intra-year outlook for 2018.

Overlapping those cycle lows, two key cycle highs were expected in 2017 – 1 – 2 months before each of those monthly cycle lows. That is when & where price action really came into play with critical indicators – like the weekly trend & weekly 21 MAC – discerning whether those periods would simply time 1 – 2 month corrections or the start of something larger.

In both cases, equities could not signal anything more than a 1 – 2 month correction and soon re-entered their prevailing uptrends. The indexes had some overlapping vulnerable periods – linked to the Decennial Cycle – that also contributed to multi-week corrections.

However, it was when the second of those periods expired – in Nov. 2017 – that the accelerated phases of both the 5-month & 10-month cycles really took hold. That spurred a sharp advance that is expected to culminate – along with those monthly cycles… in mid-Jan. – mid-Feb. 2018…

Looking ahead into 2018, an important low has been expected in March 2018, with another low likely in xxxx 2018…However, the most significant bottom is likely to wait until [reserved for subscribers only].

From a wave perspective, most indexes continue to show an evolving – and accelerating – 5th of 5th of 5th wave advance that coincides with the blow-off/accelerated phases of those monthly cycles. Most of the primary indices surged to their yearly LHRs (extreme intra-year upside targets) in 2017 and to their monthly LHRs (extreme intra-month upside targets) in Jan. 2018.

From a time/price perspective, that corroborates the monthly cycles & multi-year waves – all showing the parabolic phase of a bull market.

3 – 5 year equity traders & investors could use a weekly close below xx,xxx/DJIA [reserved for subscribers only] to lighten up (liquidate) 10 – 20% of long positions.”

Stock Indices have accelerated higher into the convergence of 5 & 10-Month Cycle Progressions – projecting a multi-month peak in mid-Jan – mid-Feb. 2018. Many indexes have given initial sell signals with the Transports already confirming an intermediate peak. Historically, that Index often leads reversals lower. Equities are entering the month of February – when a reversal lower is expected.

See Weekly Re-Lay & INSIIDE Track for additional details.