Gold Stocks (XAU) Remain Negative

Gold Stocks (XAU) Remain Negative;

Early-Feb. Peak Reinforced…

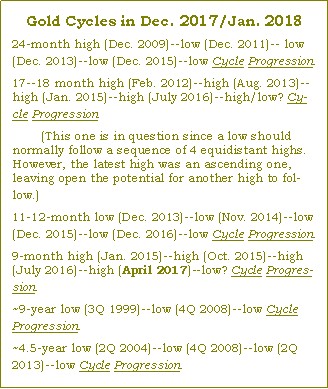

Monthly Cycles Project Nov/Dec. ’17 Low.

05/31/17 INSIIDE Track:

“The XAU remains in a more negative structure (than Gold & Silver) after spiking up to 2–3 month resistance (89.72–90.03/XAU) in April and quickly reversing lower. That was expected to lead to another drop into May 2017, which unfolded on schedule after that Index triggered a monthly 2 Close Reversal Combo sell signal.

The combination of monthly & weekly downtrends and that signal increased the potential for the XAU to ultimately extend its decline (from the early-Feb. cycle high) beyond the early-May cycle low. That remains the outlook. (A weekly close below 79.45/XAU is necessary to confirm that.)

The next intermediate low is expected in mid-June 2017 (ideally on June 16th–20th) & would perpetuate a geometric, ~90-degree cycle that currently includes lows in mid-Sept. & mid-Dec. ‘16 as well as mid-March ‘17. A drop into June 16–20, 2017 would also complete a ~9-week high-high-(low) Cycle Progression and a 34-day high-high-(low) Cycle Progression.

An intermediate low in mid-June 2017 would also complete successive declines of near equal duration (18–19 weeks each). The Aug.–Dec. ‘16 decline lasted 4 months & 1 week. A similar drop of 4 months & 1 week – from the Feb. 8th peak – projects a low around June 16th.

While examining these intermediate (1–2 month) cycles, the bigger-picture outlook & structure should not be overlooked. The monthly & weekly trends are a primary factor in that analysis.

As explained in late-2016, the XAU had turned its monthly trend down – a signal that could create a second wave down after a bounce from the Dec. 2016 bottom. That is one of many reasons why I repeatedly stress the distinction – and often divergence – between the metals (Gold & Silver) and the miners.

They are two very different entities that must be treated that way. That is why almost every multi-year turning point has had a lag or lead of 6–12 months or more. So, the XAU does not automatically benefit from a more positive structure and trend pattern in Gold & Silver. And, the outlook does not mimic that of Gold & Silver.

With that said, Gold stocks (XAU) could still see a drop below the Dec. 2016 low (even though that is far less likely in Gold). That was reinforced when the XAU rebounded into early-Feb. cycle highs and was unable to neutralize its monthly downtrend. And that is why it turned down so much sooner than Gold & Silver.

And, it is why there is even a chance – based on multiple wave relationships & projections, as well as the monthly 21 MARCs & related indicators – that the XAU could drop as low as [reserved for subscribers]

Gold stocks (XAU & HUI) remain more negative than Gold & Silver (actual metals) and have reinforced the early-Feb. peak – an intra-year high that should remain intact. Monthly & yearly cycles project a multi-month bottom for Nov./Dec. 2017. Part of that overlaps a synergistic cycle low in Gold & Silver – in mid-Dec. 2017. That reinforces the expected scenario for 1Q 2018.

See Weekly Re-Lay & INSIIDE Track for more specific expectations, targets & trading strategies.