Stocks Heighten Danger Period

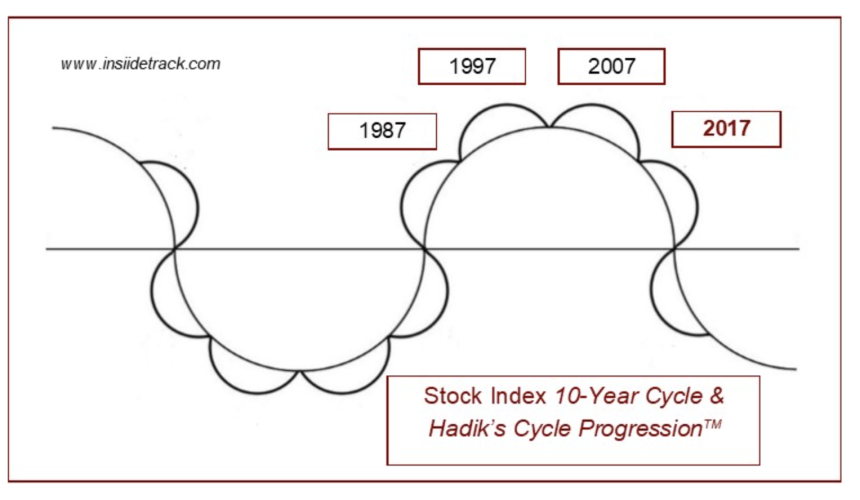

Stocks Heighten Danger Period; Aug. 15–22nd = Mini-Meltdown? Decennial Cycle Validated. 08/16/17 Weekly Re-Lay Alert: “Stock Indices rebounded in line with the Nasdaq 100’s daily trend pattern. Several Indices (Russell 2K, NQ-100, NYSE) have fulfilled a textbook daily trend pattern, turning their daily trends down on Friday and then fulfilling the normal 2–3 day bounce that typically follows (a […]

Read more