How Does Crude’s Oct. Peak Project Next Peak for ~May 2019?

How Does Crude’s Oct. Peak Project Next Peak for ~May 2019?

10/31/18 INSIIDE Track: “Crude Oil, Unleaded Gas & Heating Oil did see spikes to new highs to begin October, fulfilling their daily & weekly trend patterns as well as the weekly HLS pattern triggered in early-Sept. (when Crude corrected to its weekly HLS and monthly support while triggering a multi-week low).

That also allowed Crude to fulfill projections for a rally back to its most critical and decisive resistance at 75.00 – 77.30/CL (most synergistic at 76.45 – 77.05/CL) – a range that includes the yearly lows of 2011 & 2012 (support turned into resistance) and several other price projection indicators.

Crude spiked up to 76.90/CLX, where it peaked. In doing so, Crude also fulfilled a ~16-month low (Feb. ‘16) – low (Jun. ‘17) – high (Oct. ‘18) Cycle Progression. That cycle is one worth examining further…

15 – 17 Week Cycle

Crude also revisited and reinforced one of the most common intermediate cycles in the markets – a 15 – 17 Week Cycle. At times, that cycle shortens to 15 – 16 weeks and at other times it lengthens to 16 – 17 weeks (at which point it is roughly a 4-month – or 120-degree – cycle).

When doubled, that becomes a 7.5 – 8-month cycle – a cycle that has been discussed in numerous markets, including certain equity indexes that produced lows in Feb. ’16, Oct. ’16, June ’17 & early-Feb. ’18 before an ~8-month rally into early-Oct. ’18.

Doubled again, it produces a 15 – 16-month cycle. That largest cycle is one that has been repeatedly observed and discussed in equity markets, energy markets, interest rate & currency markets and even several commodities.

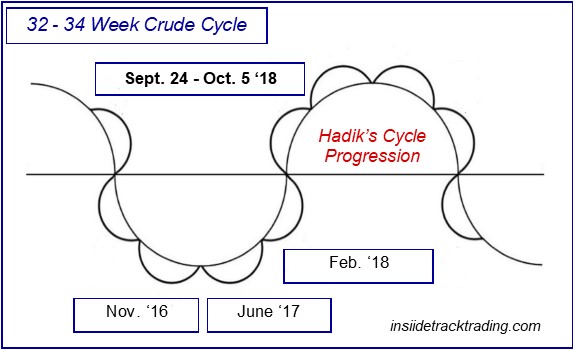

A perfect example is the ~16-month low-low-(high) Cycle Progression that has unfolded in Crude – timing lows in Feb. ’16 & June ’17 followed by a ~16-month advance into early-Oct. ’18.

That ~16-month advance broke down into an ~8-month low (June ’17) – low (Feb. ’18) – high (Oct. ’18) Cycle Progression.

Throughout its ~32-month rally, Crude has experienced competing 15 – 17 week cycles – often timing contrasting highs and lows during the same move. Some of those have already been cited.

Another example, illustrated in the accompanying diagram, is the 2x multiple of a 32 – 34 week cycle that spanned the Nov. ’16, Jun. ’17 & Feb. ‘18 lows and inverted to project an ensuing peak 32 – 34 weeks later – on Sept. 24 – Oct. 5.

That peak took hold on Oct. 3 and projects a future peak for May/June 2019. In between, an intervening peak could be seen in late-Jan. 2019 – the next phase of the 15 – 17 week cycle and a 360-degree move from the late-Jan. 2018 initial peak.”

Energy & Equity markets confirmed multi-month cycle highs in/around Sept. 2018 and fulfilled expectations for October plunges. Crude Oil is now on the cusp of signaling a larger-magnitude sell-off even as Natural Gas remains bullish. Longer-term cycles argue for a bottom in Crude in Dec. ‘18/Jan. ’19, followed by a rally into 2Q/May 2019.

Refer to latest Weekly Re-Lay & INSIIDE Track publications for additional details and/or related trading strategies.