Energy Complex Leading Inflation Surge; 3Q 2018 = Focus.

Energy Complex Leading Inflation Surge; 3Q 2018 = Focus.

05/09/18 Weekly Re-Lay Alert:

“As the Goldman Sachs Commodity Index surges to its highest level since Dec. 2014, the Energy markets are again the ones leading this latest inflationary surge. However, it would be naïve to dismiss this emerging price inflation as only oil-induced.

And, it can no longer be dismissed as ‘weak-Dollar’ related. Since the Dollar bottomed in late-Jan., the GSCI has surged about 15% while breaking above 3-year highs. However, if the Dollar turns back down after May ‘18, it could amplify this burgeoning inflation. With equities starting to show a little concern over rising interest rates, that is another factor that could move toward center stage in the next 6 – 12 months.

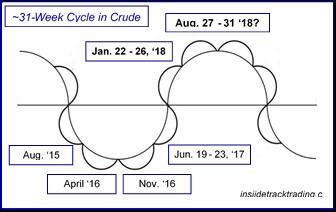

The Cycle Progression diagram above illustrates some basics of the outlook for Crude and the Energy Complex in 2018. Those markets were forecast to surge in 3Q & 4Q 2017, setting a 1 – 2 month peak in late-Jan. 2018. As they were fulfilling that, focus turned to late-August 2018 – the next phase of that ~31-week/ ~7-month Cycle Progression.

That is when a multi-quarter peak is expected. In the interim, Crude retraced into intermediate cycle lows and 4th wave support in mid-Feb. while neutralizing (but not turning down) its weekly uptrend. That confirmed that a rally to new highs was poised to unfold.

Crude was projected to rally into late-April, pull back into early-May and then undergo another quick surge into the middle half of May 2018 – when the midpoint of that ~31-week cycle – an equally prolific 15 – 16 week cycle – projects a multi-week peak. All of this was expected to reinforce the broader picture and the more intense focus on 3Q 2018. As conveyed in the April 2018 INSIIDE Track:

“Looking out over the next 6 – 12 months, a decisive turning point is expected in 3Q 2018. Starting from the larger cycles and working down, the governing 1 – 3 year cycle is a 27 – 30 month cycle that has impacted Crude since July 2006, its penultimate high. 30 months later, Crude set a major bottom in Jan. 2009.

It then rallied for 27 – 28 months (into April/May ‘11) and subsequently set its Aug. 2013 peak another 27 – 28 months later. From there, it plummeted for 29 – 30 months, bottoming in Feb. 2016. 28 – 30 months later is June – August 2018. If you look at this entire cycle from a quarterly basis, 3Q 2018 is the target cycle…

Overriding that is a ~5-year high – high cycle (3Q ‘08 – 3Q ‘13) that also targets 3Q 2018 – most likely for a peak. Underlying it is a 15 – 16 month low (1Q ‘16) – low (2Q ‘16) Cycle Progression that aligns in 3Q 2018. The ascent of that low – low cycle argues for 3Q ‘18 being a high.

Since those broader cycles leave some uncertainty (high or low… or even both), it is important to rely on more specific cycles and indicators. One of those is the 7-month low – low – high Cycle Progression that helped time the Jan. ‘18 peak. The next phase of that should also be a high – in Aug. 2018.

A more precise 31-week low – low – low – high – (high) Cycle Progression pinpoints the final week of Aug. ’18 (Aug. 27 – 31) for that potential peak. That could be reinforced with an intermediate peak in mid-May – its midpoint.”

What is intriguing about this is the potential relationship to equity markets. As the markets entered 2018, stocks were projected to set a multi-month peak in late-Jan./early-Feb. and see a sharp drop into/ through March 2018. An ensuing cycle high was/is forecast for late-June/early-July but its magnitude (higher or lower, etc.) was unclear.

Intervening daily & weekly cycles would allow for [reserved for subscribers]…

One of the multi-year cycles that could corroborate that is a 2-year/4-year cycle that has been discussed in various publications over the past few years. The following excerpt is from the Jan. 2017 ‘Stocks in 2017 – 2021’ Reportdetailing expectations for an important low in Aug./Sept. 2017 and what that would portend…

Finally, there are slightly larger-degree cycles arguing for a low in Aug./Sept. 2017 – as a precursor to a more important low in 3Q 2019. This is related to the 16-Month Cycle, as discussed in the preceding 5/31/16 analysis (see top of page 10).

Three of those 16-Month Cycles combine to create a ~4-Year Cycle – one half of one of the most consistent multi-year cycles in Stock Indices – the ~8-Year Cycle…

In each case, the Indices bottomed in August or September (with a few waiting until Oct. in 2011).

This 4-Year Cycle projects focus on July–Sept. 2019 – for another important decline & bottom.

In the interim, there is a growing potential for an intervening low at the ~2-year point (from the Aug. 2015 bottom) – surrounding August 2017. That is reinforced by a growing synergy of weekly & monthly cycles that will be elaborated later.

The bottom line is that equities could see a series of important lows set at those time frames…”

A low in Aug./Sept. 2017 would not only reinforce the focus on 3Q 2019 but also usher in the potential – even likelihood – of an intervening low in 3Q 2018, the midpoint of that 2-year cycle.

That would also arrive in the middle of the second & third 5-month highs (late Jan./early-Feb., late-June/early-July and late-Nov./early-Dec. 2018) – when a multi-month low is more likely. The August ’17 low did arrive on schedule and spurred the culminating 5-month rally into late-Jan. ’18. That heightened the focus on 3Q 2018 – when a subsequent low is likely.

And that brings us back around to the outlook for energy markets. With Crude and other oil markets increasing the potential for a culminating peak in 3Q 2018, at the same time a decisive Middle East cycle is nearing fruition (Sept. ’17 – Sept. ’18), it raises the specter of geopolitical events that could spur a final rally in oil (just as the Iran deal withdrawal has prompted the latest rally in Crude & products).

And, depending on where Crude is at that time, there remains the potential for inflation to reach a tipping point where it goes from being a boon for equities to a sudden albatross around their neck…

Crude Oil, Unleaded Gas & Heating Oil are surging into cycles that portend an intermediate peak on May 7 – 18. IF fulfilled, that would project a subsequent high 15 – 16 weeks later, in late-Aug. ’18. Weekly LHRs are converging around 73.00/CLM and remain the near-term upside target for this week.”

Oil markets fulfilling projections for overall advance into mid-May. 3Q 2018 = ultimate focus. Unleaded Gas & Heating Oil fulfilling 2.2000+ price targets as Crude nears ~73.00/CL resistance. The correlation to the overall equity market is strengthening and corroborating daily cycle highs & lows in stock indexes. Impending high could closely coincide with daily cycle highs in equity markets. See Weekly Re-Lay & INSIIDE Track for additional analysis and/or trading strategies.