Gold Sells Off into May 14 – 18 Cycle; Bounce into June 11 – 15 Likely.

Gold Sells Off into May 14 – 18 Cycle; Bounce into June 11 – 15 Likely.

05/16/18 Weekly Re-Lay Alert – Dollar Drives Deflationary Dip:

“The Dollar, after neutralizing its daily uptrend but failing to turn that trend down, rallied back to retest its high and its monthly (and weekly) resistance. In the process, that spurred a quick sell-off in currencies & commodities – including grains, livestock and metals. With Energy cycles still in a peaking phase, they were not impacted as much.

Best reflecting that, the Goldman Sachs Non-Energy Commodity Index has corrected since rallying into April 19 (Date of Aggression & culmination of initial phase or ‘month’ of Natural Year) and spiking to new 21-month highs while fulfilling a weekly trend buy signal from late-March/early-April. The Dollar’s latest rally sent that Index down again.

One noteworthy aspect of all this is how it aligns with monthly & intra-year cycles – and weekly indicators – in Gold, Silver and the XAU. Leading into this week, Gold had rebounded to its daily trend resistance and held as Silver twice neutralized its daily downtrend.

Both patterns – combined with daily & weekly 21 MARCs – led to the conclusion that a new sell-off would be seen this week after Silver rallied into daily cycle highs on May 11. The XAU was similar, rallying right to its 1 – 2 week upside target and intra-year resistance before reversing lower…

This sell-off is occurring as Silver nears the mid-point of a decisive cycle that helped pinpoint the late-Jan. 2018 peak. That cycle – a 9.25 – 9.5 month or 40 – 41 week cycle – was cited multiple times in Dec. & Jan. and projected focus to Nov. 2018, when a subsequent high is expected. (This could also create an Intra-Year V Reversal – with a high at the start of the year, a low around mid-year and then another high at or near the end of 2018.)

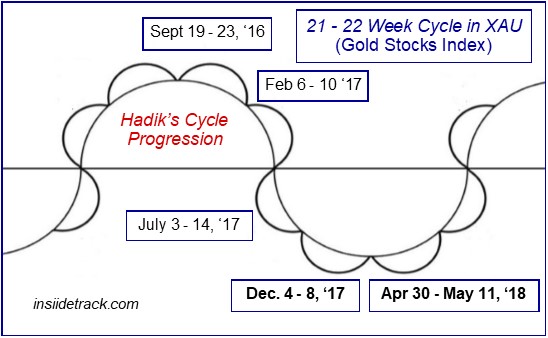

At the same time that is occurring, Gold has a combination of 22-week low-low and 11-week low-low Cycle Progressions converging on May 14 – 18. And that coincides with when the XAU was expected to set its next multi-month low based on a closely-related ~5-month (~22-week) cycle.

As stated in the Jan. 3, ‘18 Weekly Re-Lay Alert – Gold & Oil Set 2018 on Intriguing (Initial) Course:

“Gold & Silver have surged after dropping into the first half of Dec. and fulfilling multiple (yearly, monthly & weekly) cycle lows. They have since rallied sharply with Gold producing an outside-month 2 Close Reversal higher as Silver completed a corresponding monthly 2 Close Reversal higher in December…

On an intermediate basis, Gold has the next phase of an ongoing 18 – 21 week cycle – that could produce a multi-week peak – coming into play between mid-Jan. & early-Feb…

The XAU has continued to surge since fulfilling its 2 – 3 month outlook & 6 – 12 month outlook by dropping to new multi-month lows in Dec. 2017 & perpetuating an 11 – 12 month low-low-low Cycle Progression as it was testing & holding extreme support at 75.77/XAU.

That low fulfilled a 21 – 22 week high-low-(low) Cycle Progression and next comes into play in May 2018 – when another low is more likely…

Multiple monthly targets, extreme targets & key resistance projections group at 92.87 – 93.06/XAU in January and could be tested before month-end.”

Gold, Silver & XAU fulfilling potential for new sell-off into May 14 – 18 – when Gold cycles converge and a reversal higher is likely in all the metals. That is expected to spur a rally into June 11 – 15, when the next multi-week peak is projected. Watch the daily & weekly trend patterns to determine what to expect after May 18. See Weekly Re-Lay & INSIIDE Track for additional analysis and/or trading strategies.