Oil Markets Reinforce 3Q 2018 Cycle Peak; Strengthen Energy/Equity Connection.

Oil Markets Reinforce 3Q 2018 Cycle Peak; Strengthen Energy/Equity Connection.

11/14/18 Weekly Re-Lay Alert – The Energy/Equity Connection Revisited: One of the frequently-addressed topics in recent months was the strong connection/correlation between energy and equity markets. That correlation took center stage when energy markets were forecast to undergo an initial surge from Sept. 2017 into Jan. 2018, moving in lockstep with equities.

Both peaked in late-Jan. and both then suffered quick, sharp declines. Both were projected to see a trio of successive peaks in 2018 (though at different times) with a very negative period expected in the weeks/months surrounding Oct. 2018.

The Aug. 22, 2018 Alert revisited this topic as energy markets were fulfilling multi-month & multi-year cycles projecting a peak in 3Q 2018. That Alert observed:

“Since May 2015, Crude Oil and the overall equity markets have moved in similar trends. This does NOT mean that every rally and decline were in lockstep with each other.

And it does not suggest that every multi-month or multi-quarter or multi-year top in one was a corresponding extreme in the other. However, the general trends and cycles have coincided.

Both markets experienced significant drops into Aug. 24, 2015 and then suffered subsequent drops that bottomed in Jan./Feb. 2016. Both have rallied since then.

From early-2016, both Crude and the DJIA rallied for 3 – 4 months and then corrected for 2 months.

Both moved progressively higher into late-Jan. 2018, with the strongest rallies unfolding in July ’17 – Jan. ’18.

Both dropped sharply into early-Feb. ‘18 and have moved higher since then.

Both set intervening highs in late-May – early-June ‘18 but have since exceeded those highs.

Both, on a short-term basis, pulled back into Aug. 15/16 and then projected rallies back to their highs.

To reiterate, the intervening moves were often very different. And, the intervening swings were not in lockstep with each other. However, a cursory glance at both charts reveals a correction from May ’15 into Jan. ’16 and an unfolding uptrend since then.

The point?

The reason for addressing this has more to do with oil than with equities (although there is obviously overlap, particularly in an index like the S+P 500).

The 2017/2018 outlook for energy markets was to see a strong rally into Jan. 2018 and then subsequent highs…

Crude maintains its most critical and decisive resistance at 75.00 – 77.30/CL – a range that includes the yearly lows of 2011 & 2012 (support turned into resistance).”

Since then, the thinking was that both equities and energy markets would set significant peaks and see sharp sell-offs in Oct. 2018. The magnitude of these potential peaks is what makes them worth revisiting.

Since 3Q ’17, the outlook for energy markets has overlapped Middle East cycles – both of which focused on late-Sept. ’17 – late-Sept. ’18 as a ‘bullish’ period. Late-Sept. 2018 was expected to be the culmination of advances in oil markets and Middle East tensions.

That was due to many factors, including the monthly, quarterly and yearly cycles reiterated in the April 2018 INSIIDE Track. It explained:

“Crude Oil – Multi-year trend slowly turning up after fulfilling cycle low in early-2016 – the convergence of monthly & yearly cycles. Cycles turned bullish in 3Q ‘17 and could spur additional upside into 3Q 2018…

Looking out over the next 6 – 12 months, a decisive turning point is expected in 3Q 2018. Starting from the larger cycles and working down, the governing 1 – 3 year cycle is a 27 – 30 month cycle that has impacted Crude since July 2006, its penultimate high. 30 months later, Crude set a major bottom in Jan. 2009.

It then rallied for 27 – 28 months (into April/May ‘11) and subsequently set its Aug. 2013 peak another 27 – 28 months later. From there, it plummeted for 29 – 30 months, bottoming in Feb. 2016…If you look at this entire cycle from a quarterly basis, 3Q 2018 is the target cycle…

Overriding that is a ~5-year high – high cycle (3Q ‘08 – 3Q ‘13) that also targets 3Q 2018 – most likely for a peak.

Underlying it is a 15 – 16 month low (1Q ‘16) – low (2Q ‘16) Cycle Progression that aligns in 3Q 2018. The ascent of that low – low cycle argues for 3Q ‘18 being a high.”

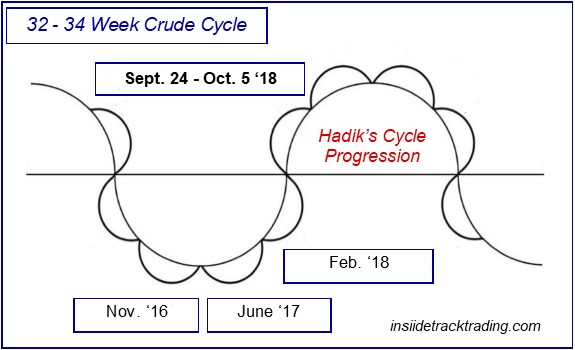

Crude set an initial peak in early-Sept. but soon signaled that was not a final peak – only a 1 – 3 week top. It wasn’t until late-Sept. that Crude finally broke out to new highs as it was approaching the convergence of multiple weekly cycles in late-Sept./early-Oct., including a 16 – 17 Week Cycle, a 32 – 34 Week Cycle and the culmination of back-to-back 15-week advances.

That was reinforced with the Oct. 17 Alert, featuring the accompanying diagram and detailing this web of recurring cycles. It focused on the 15 – 17 Week Cycle and its multiples, highlighting the following:

“One of the most common intermediate cycles in the markets is a 15 – 17 Week Cycle…When doubled, this becomes a 7.5 – 8-month cycle. That has been cited in numerous markets, including certain equity indexes that produced lows in Feb. ’16, Oct. ’16, June ’17 & early-Feb. ’18 before an ~8-month rally into early-Oct. ’18.

Doubled again, it produces a 15 – 16-month cycle…A perfect example is the ~16-month low-low-(high) Cycle Progression that has unfolded in Crude – timing lows in Feb. ’16 & June ’17 followed by a ~16-month advance into early-Oct. ’18.

That ~16-month advance broke down into an ~8-month low (June ’17) – low (Feb. ’18) – high (Oct. ’18) Cycle Progression.”

The energy complex fulfilled all of these cycles and has plummeted since then. Crude & Unleaded Gas have retested their intra-year lows – completing a type of Intra-Year Inverted V (even though the peak did not occur at the mid-year point as that pattern normally produces) reversal lower…

Crude Oil, Unleaded Gas & Heating Oil have plummeted from multi-month and multi-year cycle highs in 3Q 2018 with Crude and Unleaded Gas now retesting their 2018 lows – critical levels of 6 – 12 month support. Heating Oil remains a little ‘less weak’, retesting the high of its year-opening range…

Natural Gas remains bullish and on course for an overall advance into mid-to-late-Dec. It surged to begin the month of November, reinforcing a breakout higher as it entered the parabolic phase of this ~10 – 11 month advance (90/10 Rule of Cycles).

It was moving in approximate 0.3000 ranges (2.85 – 3.15 – 3.45 – 3.75/NGZ) and has just fulfilled its primary objective for this time period, based on its 1 – 2-year wave objective, an accelerated advance to ~5.0000/NG.”

Crude Oil has plummeted since peaking in early-Oct. while fulfilling multi-month, multi-quarter & multi-year cycle highs in/around Sept. 2018… and also completing the latest phase of Middle East cycles that projected higher oil prices into late-Sept. 2018. Natural Gas remains bullish but has just attacked ~5.000/NG – the primary upside target for that phase of its advance.

Refer to latest Weekly Re-Lay & INSIIDE Track publications for additional details and/or related trading strategies.